A Brighter Way Group Plan Solution

WHAT IS A BRIGHTER WAY 401(K) GROUP PLAN SOLUTION?

更光明的方式401(k)团体解决方案计划(GPS)是单一雇主确定的供款计划的集合, through a pooled plan arrangement,可以共享一个共同的计划管理人、指定受托人、投资菜单、计划年度和受托人. Participating employers do not have to share a common association or industry. This pooled-plan solution is designed to reduce the administrative burden, transfer certain risks, and potentially lower the overall plan cost. 它将代表雇主的专业团队聚集在一起,这样他们就可以专注于最重要的事情:经营他们的企业,而不是他们的退休计划.

Review This Quick Guide to Pooled Plan Araangements

Each adopting employer signs an agreement to adopt a plan document under the GPS, 而且,每个雇主都被视为出于某种监管目的而采用自己的计划. 所有组件计划都使用相同的服务提供商和投资工具,这使得它们有可能通过规模经济来节省成本.

WHY SHOULD YOU CONSIDER A BRIGHTER WAY 401(K) GROUP PLAN SOLUTION?

BENEFITS TO PLAN ADVISORS:

一个更光明的方式401(k) GPS让您有机会成功地扩大您的退休计划咨询业务, which can help to increase your firm revenue and profitability. ERISA 3(38)投资经理使用低成本的机构基金来处理自由选择和监控基金,从而消除您和您的客户的负担. 3(38)经理是cefex认证,并创建了一个自定义目标日期的保守集体投资信托系列, moderate and aggressive options for each vintage.

所有的基金监测和季度投资经理报告提供给您的定期客户审查, saving you hours of review and prep time, 让你专注于与客户会面,改善员工参与等计划指标, 递延利率和优化资产配置,其中最大的机会是改善参与者的结果.

Check out this video to learn more!

BENEFITS TO PLAN SPONSORS:

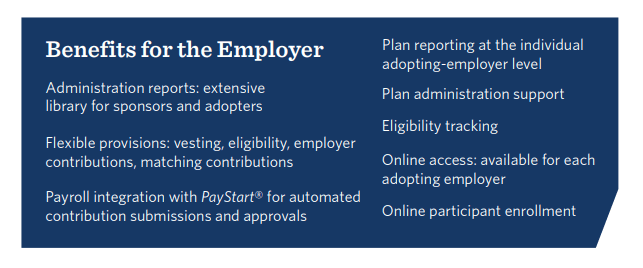

一个更光明的方式401(k) GPS为您的员工提供最好的机会,通过简单的方式成功地为退休储蓄 & transparency, scale, flexibility, and responsive local service. 它是基于Rea自己的401(k)计划的信托最佳实践和流程, 哪个项目的参与率高于平均水平,贡献率低于平均水平.

更亮的方式401(k) GPS将允许您采用401(k)平台,具有竞争力的价格, 结合行业最佳的计划管理实践,由重视并理解审慎流程和透明度的注册会计师设计.

Check out this video to learn more!

欲了解更多如何透过全球定位系统管理您作为计划保荐人的信托风险,我们诚邀您 download the whitepaper written by The Wagner Law Group offered courtesy of Transamerica.

Your Dedicated Team

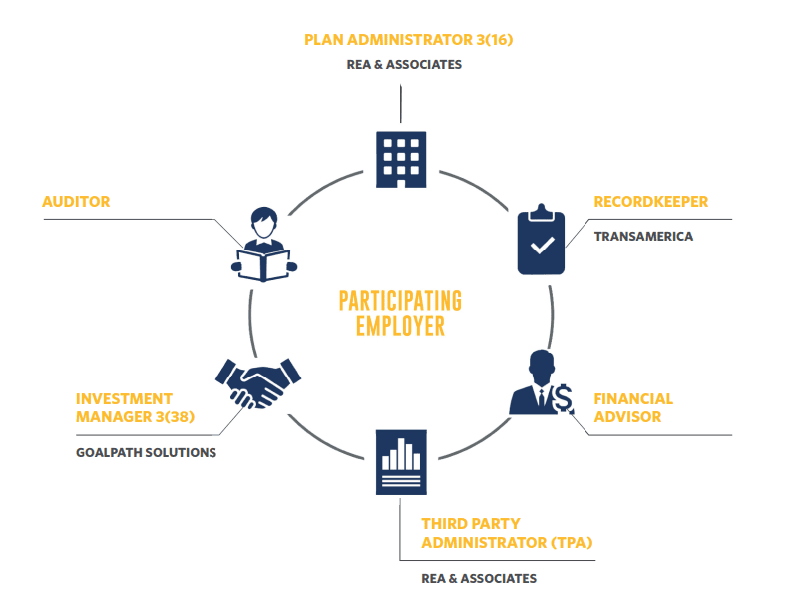

Roles of the Professional Services Team

Plan Administrator – Rea & Associates

- Serves as named fiduciary

- Performs administrative functions to keep plan compliant

- Responsible for day-to-day plan operations, including

- Completion, signing and filing of Form 5500

- QDRO determinations

- Benefit payment authorization

- Ensuring proper spousal consent obtained for payments

- Distributions

Record Keeper – Transamerica

- More than 85 years of experience in retirement

- Pioneer and market leader in pooled plans

- Created pooled-plan solutions starting in 2001

- Provides support to plan participants to and through retirement

Financial Advisor – Selected by the plan sponsor

- Helps the sponsor determine plan objectives, options for plan design enhancements, and monitor plan statistics

- Offers services to help increase plan participation

- Lends support with a comprehensive education program for employees

- Provide services such as benchmarking of fees and services, and deliver 3(38)-provided investment reviews

- 帮助确保计划发起人了解向第三方管理者提供年终数据的重要性,以便及时完成所有所需的测试/文件

Third-Party Administrator – Rea & Associates

- Helps adopting employers with plan design

- 提供持续的合规服务,包括强制测试和管理

- Offers local support for employer

Investment Manager – GoalPath Solutions

- Responsible for the selection and monitoring of funds in the investment lineup

RESPONSIVE LOCAL SERVICE FROM A PROVEN LEADER

Rea & Associates已被卓越受托人中心(CEFEX)认证为第三方管理人的行业最佳实践. 认证意味着我们接受年度评估,以验证我们继续遵守ASPPA退休计划服务提供商的实践标准. 卓越是我们文化的一部分,我们通过不断改进业务的各个方面来努力实现这一目标. 该认证证明Rea为我们的退休计划客户提供了行业领先的护理服务. 我们的CEFEX认证模拟年度尽职调查,以确保提高效率, operational consistency, improved decision making and accountability for our processes.

Additionally, 作为ClearlyRated的最佳会计®客户服务卓越奖的多年获奖者, Rea’s client satisfaction scores are nearly double the industry average. 我们为我们出色的客户服务感到自豪,我们保证您的电子邮件和电话将在24小时内回复-如果不是更早的话.

Disclosures

The GROUP PLAN SOLUTIONSM (GPS) is not a multiple employer plan (MEP). Unlike a MEP, 某些计划资格和ERISA要求适用于个人计划级别. An employer participating in a GPS retains certain fiduciary responsibilities, 包括保留和监督3(16)计划管理者的责任, for determining the reasonableness of its fees, and for periodically reviewing the GPS as a whole. Transamerica does not act as a 3(16) plan fiduciary.

Before adopting any plan, sponsors should carefully consider all of the benefits, risks, and costs associated with a plan. 有关退休计划的信息是一般性的,不打算作为法律或税务建议. Retirement plans are complex, 它们所依据的联邦和州法律或法规因不同类型的计划而异,并且可能会发生变化. In addition, some products, investment vehicles, and services may not be available or appropriate in all workplace retirement plans. 计划发起人和计划管理者可能希望寻求法律顾问或税务专业人士的建议,以解决他们的具体情况.

选择联合计划并不能消除计划发起人确定计划是否适合其具体情况的需要. 在没有事先获得适当的专业意见和考虑情况的情况下,不应根据这些信息作出任何投资决定. Contact your tax advisor, 会计师和/或律师在作出任何涉及税务或法律的决定之前.

此处包含的信息可能是从一系列第三方来源获得的,被认为是可靠的,但不能保证.

GoalPath Solutions是一家独立的注册投资顾问,担任该计划的3(38)投资经理. As a named fiduciary to the plan, GoalPath is responsible for selecting, monitoring, and ongoing due diligence of funds in the lineup.

Logos and trademarks are the intellectual property of their respective owners. Rea & 联合律师事务所、GoalPath Solutions、Transamerica和瓦格纳律师事务所均为非附属机构.